If you’re part of a Consumer Packaged Goods (CPG) company, you’re likely all too familiar with chargebacks or deductions from retailers. Whether it’s giants like Costco, Walmart, Kroger, and Target, or supermarkets such as Vons, Wholefoods, Albertsons, and Publix, each has its own set of rules that, and if not strictly followed, can lead to chargebacks that erode your profits.

Chargebacks or deductions are fees that you encounter when we fall short of meeting each retailer’s specific requirements. Regrettably, these fees can accumulate, costing an average CPG company about $2.7 million each year (depending on their size and volume).

This guide is here to help.

We’ll unravel the complex web of retailer requirements, show you how to reduce chargebacks, and guide you on what steps to take if you’re faced with one. Our ultimate goal is to help you keep more of your hard-earned money, ensuring it’s being put to good use in your business.

So, are you ready to dive into this straightforward, easy-to-follow guide? It’s brimming with practical knowledge and tools to handle CPG chargebacks, paving the way for your business’s sustained success.

Let’s get started!

Part 1: The Basics of CPG Chargebacks

1.1 What Are CPG Chargebacks & Deductions?

Chargebacks, also known as retail deductions, are fees that retailers like Costco or Walmart take from your payment.

Imagine you are a CPG company, let’s say, you make delicious chocolate bars. You have an agreement to sell your chocolate bars to a big retailer, like Costco, for $1 million.

However, let’s say there’s a small hiccup with your delivery. Maybe your delivery truck arrived late, or the barcodes on the chocolate bars were smudged. Because of these issues, Costco decides to enforce a chargeback or retail deduction.

It seems crazy and quite unfair, right? Especially since a delay could be completely out of your control.

In real terms, this means

Costco will take a percentage of your payment as a penalty. If the chargeback rate is 2%, for example, they will deduct $20,000 from the $1 million they owe you. So, instead of getting the full $1 million, you will only receive $980,000.

That’s what we mean when we talk about CPG chargebacks or retail deductions. They are essentially penalties for not meeting the retailer’s requirements perfectly.

Let’s dive into some more specifics that can set off these potentially substantial penalties:

- Late or Delayed Shipments: Timeliness is of utmost importance in the retail industry. Retailers expect your shipments to arrive at their distribution centers or stores according to the agreed-upon schedule. If there are delays in your deliveries, retailers may apply chargebacks as a penalty for non-compliance.

Example: Foxstone Inc has a shipment of $500,000 worth of healthy snack bars scheduled for delivery to Target between 9-10 am on Monday. However, due to unforeseen logistics issues, the shipment is delayed by two hours. As a result, Target imposes a 3% chargeback on the order, resulting in a $15,000 deduction from your payment

- Condition of Goods: The condition of your products is critical to maintaining a positive customer experience. Retailers may impose chargebacks if they receive damaged or unsellable goods.

Example: You’ve got a $2 million shipment of organic cereals for Costco, but some boxes get damaged in transit. If Costco imposes a 3% chargeback, that’s a significant $60,000 loss straight away.

- Packaging and Labeling: Retailers have strict requirements for product labeling, including barcode accuracy and readability. If your products’ labels are found to be incorrect, smudged, or unreadable, retailers may apply chargebacks for non-compliance.

If your $3 million order of canned goods to Walmart misses the necessary barcodes on some cans, you’re in for a shock. A chargeback fee of 1.5% equals a hefty $45,000 deduction.Example: Harry Beverages ships a large order of bottled drinks to Walmart, but a batch of labels gets damaged during transit, leading to unreadable barcodes. Walmart imposes a 2.5% chargeback on the $1 million order, resulting in a $25,000 deduction.

- Order Completeness: Retailers expect your company to fulfill orders accurately and completely. If your order fill rate falls below the retailer’s requirements, they may apply chargebacks to account for the incomplete or incorrect fulfillment.

Example: Energize Pro delivers a $1.5 million shipment of their popular energy drinks to a major retailer, but some of the cases have damaged packaging due to mishandling during transportation. The retailer applies a 2% chargeback on the order, resulting in a $30,000 deduction from the payment.

- Advance Ship Notices (ASNs): ASNs play a critical role in the retail supply chain. Retailers rely on ASNs to plan for incoming shipments. Providing incorrect or incomplete ASNs can disrupt their operations, leading to chargebacks to cover any resulting expenses or disruptions.

Example: Gourmet Delights sends an ASN for a $3 million shipment to Albertsons but fails to include the correct number of pallets. Albertsons applies a 1.5% chargeback, resulting in a $45,000 deduction from the payment.

- Late Invoices: Timely and accurate invoicing is crucial for smooth payment processing and maintaining a good relationship with retailers. If your food company fails to submit invoices on time, retailers may impose chargebacks to cover the administrative costs and delays caused by the late invoicing.

Example: Wholesome Harvest, a supplier of organic grains, delivers a large order to a supermarket chain. However, they delay sending the invoice for the delivered goods, causing a processing delay for the retailer. The supermarket applies a 2% chargeback on the $120,000 order, resulting in a $2,400 deduction from the payment.

- Incorrect Invoices: Retailers expect invoices to be accurate, containing the correct product details, quantities, and agreed-upon prices. Any errors in the invoices can lead to confusion and additional administrative work for the retailers, prompting them to apply chargebacks.

Example: Garden Fresh Produce sends an invoice to a specialty store for their shipment of fresh vegetables. Unfortunately, the invoice contains incorrect pricing for some items, leading to discrepancies in the total amount owed. The store applies a 1.5% chargeback on the $80,000 order, resulting in a $1,200 deduction from the payment. - Invoicing Discrepancies for Promotions or Discounts: If your CPG company offers special promotions, discounts, or rebates to retailers, it’s crucial to ensure that the invoices reflect the correct pricing. Any discrepancies can lead to chargebacks and deductions.

Example: Juicy Juices provides a temporary discount on their bottled juice products to a supermarket during a promotional period. However, the discounted pricing is not accurately reflected in the invoice, causing confusion for the retailer’s accounting department. The supermarket applies a 1% chargeback on the $70,000 order, resulting in a $700 deduction from the payment. - Manufacturer Chargebacks (MCBs): MCBs are discounts offered by a brand to a retailer on their products. These discounts are then passed on to consumers during promotional events. Brands reimburse the retailer for the discounted amount, and MCBs help drive product sales and brand awareness. Read more about MCBs here

Example: JuiceBurst, a fruit juice brand, collaborates with Albertsons for an MCB promotion. They offer a 20% discount on their organic juice bottles, reducing the retail price to $2.80. JuiceBurst reimburses Albertsons for the discount. However, without Point of Sale (POS) data, JuiceBurst struggles to verify if the discount was actually passed to consumers. This uncertainty could lead to chargebacks if the promotion isn’t validated, affecting JuiceBurst’s payment.

1.2 The Impact of Chargebacks on CPG Companies

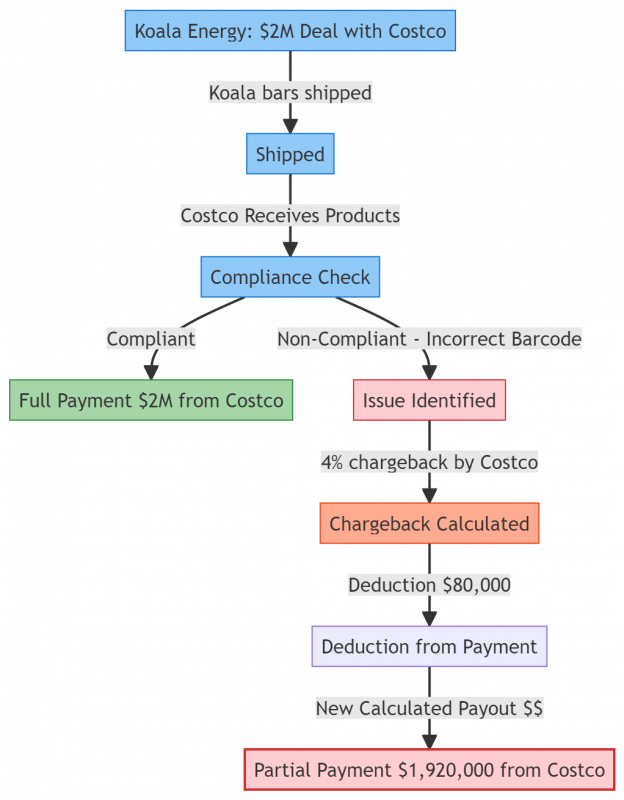

We’ll share a true story about one of our clients, while respecting their confidentiality. We’ll call this company ‘Koala Energy’, a name we chose purely for discussion. Koala Energy specializes in crafting energy-packed protein cake bars, a favorite amongst health enthusiasts.

Koala Energy had a significant breakthrough when they secured a $2 million deal with Costco. They were set to distribute their top-selling protein cake bars to Costco stores nationwide, a big achievement for the brand.

However, their joy turned into concern when an unexpected issue cropped up at their production facility. A batch of protein bars didn’t get the right packaging due to a minor technical glitch. The bars were perfectly good, but the packaging didn’t meet the strict quality checks at Costco.

Upon identifying the issue, Costco enforced a 4% chargeback on the entire order due to the packaging non-compliance. Suddenly, Koala Energy was faced with an $80,000 deduction from their payment. This chargeback didn’t just reduce their expected profits but also risked their new partnership with Costco.

This was a hard lesson for Koala Energy, showing them the severe financial implications of CPG chargebacks. The incident emphasized the need to adhere to the quality requirements of each retailer meticulously.

Koala Energy’s experience stands as a real-life example of how serious CPG chargebacks can be, and how they can potentially harm your profits. As we continue with this guide, we aim to provide you with the necessary understanding and strategies to prevent such costly situations in your business.